![]() Insights

Insights

The best digital marketing strategy is one that informs, and is informed by, wider business strategy and overall marketing goals. Digital marketing has the benefit of being extremely data-driven, with channels across the board collecting data, which can be used to provide insights on your customers and their purchase habits.

Search data is no exception, and one area where these insights can (and should) be applied is in your product strategy.

Knowing what it is your customers want and are searching for allows you to meet this demand. Not all search data is equally useful in this scenario; here I will run through the data that can help to inform your product strategy.

For many retailers, being able to tap into new trends before they explode means being able to capitalize on early sales with little competition.

You can use Google Search Console data to monitor the impression growth of products and categories and see where demand is increasing; if the URL of a product or category is showing up more and more, it is a good indicator that there is a growing demand in this area and that supply/ stock needs to be built up in this area so you are prepared for when demand peaks.

You can also use this time to build out related content and new product or category pages (if you haven’t done so already) and begin to build authority for these search terms so that as the trend becomes more widespread, your website is already ranking well for these keywords.

Google trends can be used to identify when seasonal or event-triggered buying trends, such as bikinis, festival clothing or stocking fillers, begin to rise. Looking at the data for these searches over the last few years will help you to identify where demand starts to pick up (and therefore when you need to have your landing pages in place) and when it peaks (which can help you to manage supply/ stock to ensure you have enough where it’s needed without being left with excess).

Knowing where demand begins to grow, peak and then trail off means you are also better able to plan your yearly marketing strategy around these evergreen products; for example, planning and publishing content in quiet periods to build up organic authority and adjusting paid media budgets so spend increases as demand grows.

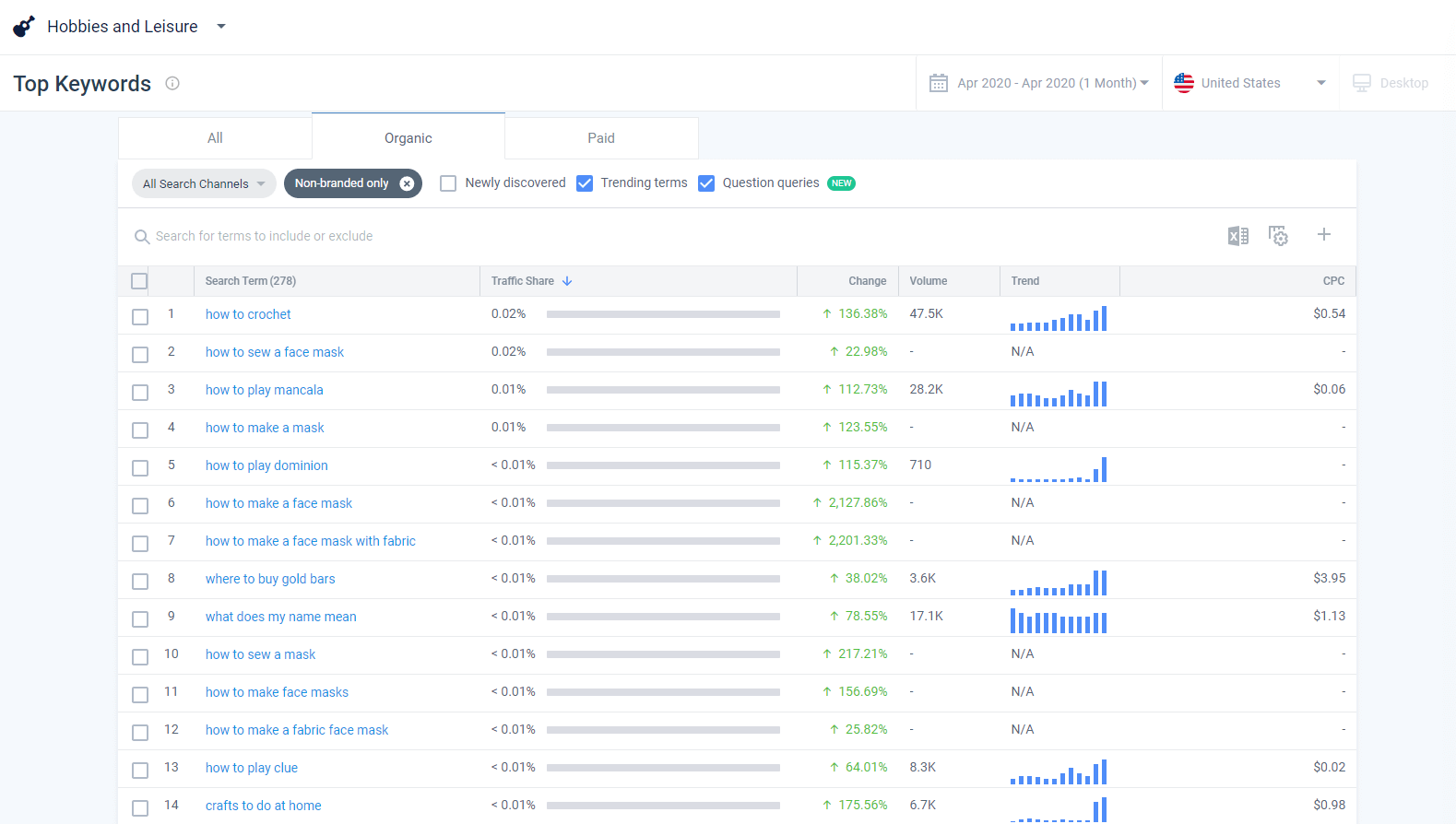

Tools like SimilarWeb can also be used to identify very fast-moving search trends which can alert you to new products that are fast gaining popularity where previously it had little to no interest. This is particularly the case in fast-fashion and wellness industries where trends come and go in extremely short spaces of time, giving brands little time to purchase products let alone plan a launch strategy around them.

Feeding fast-growing searches back into your buying team can inform their buying strategy by identifying trends well before they peak.

Within SimilarWeb’s Category Analysis, there are two options which are helpful in this scenario.

Newly discovered terms are search terms which appeared in the last month but didn’t do so in the month before. This is hugely helpful when you’re trying to be one step ahead of your competition in terms of ranking well organically for upcoming trends and also on-site merchandising.

At the time of writing (mid-October 2020), some of the newly discovered terms being reports inside the Fashion and Apparel category are:

Given the time of year, these all make a lot of sense. We all know that search volume around coats and boots starts to climb in September each year but armed with the knowledge of specific search terms means that you can pull out trends and merchandise accordingly.

This is where you can start to find trends outside of the usual seasonal patterns. This could indicate new trends that you may want on your radar.

At the time of writing, the following terms are trending:

Within this category, there are of course trends that reflect seasonal demand such as:

Example of a report from SimilarWeb<

As well as newly discovered and trending terms, in the same part of SimilarWeb there’s also a new feature called ‘question queries’.

These are worth assessing as you’re also able to see the trendline and pickup on upcoming information queries that could be turned into supporting informational content to help semantically power commercial queries as well as increasing the chance of a conversion.

One interesting example at the time of writing is ‘how to measure foot width’. The volume behind the query has increased by nearly 350% and makes sense at this time of year as people are thinking about transitioning from their summer to winter footwear. It is also reflective of a trend towards shopping online, as consumers are less able to try on multiple sizes than if they were to buy in-store so have a greater need to know their size.

Writing a guide on how to do this and including a link to it from relevant footwear categories (and vice versa) makes a lot of sense from both an SEO and UX perspective.

Search data can be invaluable in informing what products to buy and when, but these insights can also be used to influence your online strategy.

For example, fast impression growth of a particular product may highlight the need for a category page dedicated to similar products so that users can easily find a product that best suits their needs on your website rather than returning to the SERPs to find something.

New landing pages can take time to build organic authority, so it is important to work with any paid media teams to capitalize on the growing interest and drive paid traffic in the interim. Any PPC data you get can be fed back into the buying team as it highlights which particular products perform well and need to be stocked up on.

You may also want to work with your online merchandising team to ensure the product is strategically placed to build authority to the page quicker, as well as attract more traffic from users who are on the site. Placing the newly created category page higher up in the site structure, adding it the main navigation bar or adding banners to the home page are all effective ways of driving through more link equity and site authority and can lead to the category page ranking quicker (which is essential in driving organic traffic) and also means website users are more likely to click through to that page, even if they were on-site looking for something else.

As an agency, we are constantly looking at ways we can provide more value to our clients and integrating the work we do with other internal and external teams, sharing insights and working towards overall business objectives alongside channel goals is key to improving wider performance and growth.

We can help you to achieve your wider business goalsGet in touch