![]() Insights

Insights

Black Friday is a busy annual tradition for consumers and businesses. It signifies the beginning of the Christmas season, with everyone thinking about gift-giving and family get-togethers, and for many sectors, transactions during Black Friday outperform the rest of the traditional winter sales period.

Due to the short-lived, fast-paced nature of Black Friday and Cyber Monday, having a robust, adept digital marketing strategy with a strong focus on paid media is crucial for grabbing a significant share of sales and improving annual profit.

To ensure your business takes full advantage of these opportunities, we’ll share nine digital marketing tips that will assist you in finalising your paid media strategy for Black Friday.

Black Friday weekend is the perfect opportunity for consumers to buy products for their friends, family, and, of course, themselves. However, due to an incredibly broad demographic participating in the annual event, your team may need help identifying which products should be front and centre of your campaigns. To help your team plan, the Retail Gazette shared John Lewis’s top-selling Black Friday products in the UK for 2022. These included:

By exploring industry trends during Black Friday, you can highlight products that typically attract consumers and invest your budget into items with proven historical value.

After you decide which products to focus your marketing efforts on, your team needs to explore the effectiveness of different ad platforms to set your strategy up for success. Although you can continue to use the channels you are most familiar with, reviewing your Black Friday data from the previous year can help reinvigorate your approach. This review gives you more understanding of which PPC and Programmatic channels perform strongest, enabling you to maximise sales potential.

Testing before the Black Friday sales period minimises potential problems and ensures a smoother operation. Experimenting with different text and CTAs to identify which ad copy improves performance, as well as checking your shopping feed and ensuring tracking is set up, eliminates unnecessary setbacks throughout Black Friday.

You must spend money to make money. And when it comes to Black Friday, the more you spend, the more you will make. Increasing or uncapping your budget, when backed by testing and data, will allow you to capture as many sales as possible. Adspert notes that Amazon recommends increasing Ad bids between 10-30% during Black Friday and Cyber Monday to increase chances of getting the most sales.

If you struggle to find available digital advertising budget, consider using Google’s shared budgets. Google’s shared budget feature automatically allocates a budget for you across your holiday campaigns, depending on performance. So higher-performing campaigns are prioritised over lower-performing ones.

Consumers do not behave the same way during Black Friday as they do the rest of the year. Because of this, you cannot effectively predict customer behaviour, and this makes planning digital advertising difficult. Manually adjusting PPC bids in real time is especially problematic. So, to interpret sudden changes in behaviour more efficiently during seasonal periods, Google introduced seasonality adjustments for smart-bidding.

Now, you can apply your predicted conversion rate for the Black Friday period using data from previous years, and Google will consider these adjustments during the selected date range. Other smart-bidding strategies can also improve your campaign performance throughout Black Friday, depending on your objective.

For example, Maximise Conversion Value bidding helps you achieve the most valuable conversions with your available budget. Target ROAS bidding allows you to drive additional revenue at your target return on ad spend allows you to drive additional revenue at your target return on ad spend.

Many people use Black Friday sales to buy products they would not usually purchase, including one-off, big purchases. Broadening the target audience for your digital advertising widens your reach and ensures paid media advertisements are in front of these hard-to-predict shoppers. An easy way to expand your reach is to increase your lookalike audience pool percentage during the promotion.

For your PPC campaigns, consider using Dynamic Search Ads to capture search queries not in your keyword list automatically. This approach will ensure you are still purchasing ads for new and relevant search queries that you may not have on your radar. Another reason to expand your targeting is because purchase intent is higher throughout Black Friday. Users who may not have purchased from your store previously due to hesitation over quality or price will be more willing to buy from your brand, as Black Friday promotions reduces barriers.

Shopping ads are more visual and information-rich than text ads and attract users with higher purchase intent. Running shopping campaign ads for your promotional items helps to drive more clicks and conversions. Performance Max campaigns with Smart bidding to improve Black Friday sales as much as possible.

You will likely be battling multiple competitors during Black Friday. So, you must ensure your creative is distinctive when running paid social ads to make your brand stand out. Using fonts, colours, and words recognisable to your brand (while making sure all are beautiful and eye-catching) will help determine if a user clicks on your ad over another.

Creating an Amazon brand store provides a more significant opportunity to highlight your products, drive traffic, and improve sales throughout Black Friday. Each marketplace store has a unique URL linked to every product, so users can browse your offerings more easily.

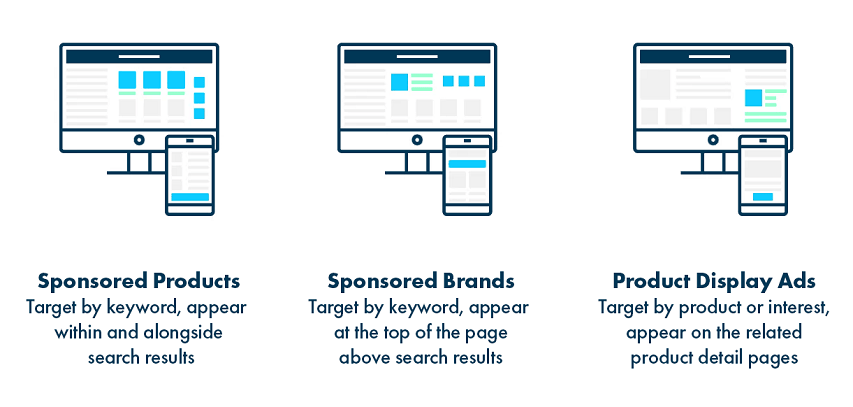

Having a brand store also means you can run sponsored brand ads to target specific keywords at the top of users’ searches. Amazon recommends running all three types of ads (Sponsored Products, Sponsored Brands, and Product Display Ads) during Black Friday.

Due to the competitive nature of Black Friday, effectively planning your PPC campaigns is crucial for cutting through the noise. For each product or category, you want to run ads for, you need to know the following:

You must also stay aware of inventory levels to ensure you stop promoting products that sell out quickly. In addition to planning your paid media ads, you need a contingency plan. What will you do if your performance is poor? What if your budget runs out too fast, or the keywords you are bidding on are too expensive? Ensuring everyone knows what to do in these situations prevents issues throughout Black Friday.

Top-level decision processes, like how to request a budget increase when an ad campaign takes off, need a clear outline leading up to the holiday. Those working on the account may need to make snappy decisions outside of usual working hours. Having clearly defined rules, such as increasing the budget by an agreed-on amount if ROAS is over a certain percentage, will help keep campaigns running smoothly.

Do you want to improve how you track your retail data?Learn how by streaming our retail-themed podcast episode

![]() Insights

Insights

![]() Insights

Insights

![]() Insights

Insights